Remote Work Challenges in Credit Union Contact Centers — Overcoming Obstacles

The work-from-home (WFH) revolution has transformed pretty much every industry, including credit unions. As financial institutions increasingly adopt remote contact center models, they face unique challenges in maintaining service quality and operational efficiency. While remote work offers flexibility and cost savings, it also brings a set of challenges that need to be addressed to ensure that credit unions can continue to provide exceptional service to their members.

The rise of remote work in credit unions

Remote work in credit union contact centers has been on the rise, especially since the onset of the COVID-19 pandemic. According to a report from the Credit Union National Association (CUNA), around 60% of credit unions had implemented some form of remote work arrangement by mid-2023. This shift has been driven by the need for flexibility, cost-efficiency, and the evolving expectations of employees and members alike.

However, while remote work offers several benefits, it isn’t always smooth sailing for either the credit union or the employee. That’s why it’s crucial to take a proactive approach and address key challenges before they impact member experience and operational efficiency.

4 key challenges of remote work in credit union contact centers

So what are the remote work hurdles that credit unions must overcome? Primarily, there are four obstacles:

1. Internet connectivity issues

One of the most significant challenges with remote work is ensuring that WFH contact center agents have reliable internet connections. Poor connectivity can lead to dropped calls, slow response times, and overall dissatisfaction among members. A report by Forrester Research highlights that 56% of contact center agents reported experiencing connectivity issues that impacted their productivity. This issue is compounded in a remote setting where agents are responsible for their own internet infrastructure.

2. Hiring and onboarding difficulties

Finding and hiring the right talent for remote contact center roles can be more challenging than traditional in-office positions. According to a study by Gartner, 49% of organizations reported difficulties in hiring remote workers due to concerns over their technical setup and work environment. For credit unions, this means that ensuring new hires are equipped with the necessary tools and reliable internet connections is critical for maintaining service standards.

3. Employee retention

Remote work can lead to isolation and burnout, which may affect employee retention. A survey by Gallup found that 39% of remote workers felt disconnected from their team, which can contribute to job dissatisfaction. Additionally, remote employees may face difficulties in accessing support and training, which can impact their performance and long-term commitment to the organization, and employees who are frustrated with the technology at their disposal (or lack of it) are not likely to stick around. In other words, a WFH employee’s sense of connectedness begins—and ends—with that employee’s ability to do their job through a stable internet connection.

4. Monitoring and performance management

Managing and monitoring remote contact center agents presents unique challenges. Without physical oversight, ensuring that agents adhere to performance metrics and maintain productivity can be difficult. Traditional monitoring tools may not be sufficient for capturing the nuances of remote work environments. Therefore, it’s imperative to monitor whether a remote agent is actively connected and able to take calls.

How PingPlotter’s NetCheck can address these challenges

With PingPlotter’s NetCheck feature, credit unions can tackle these remote contact center challenges. Here’s how:

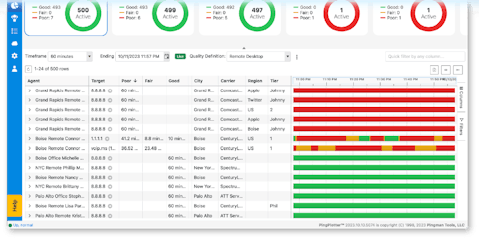

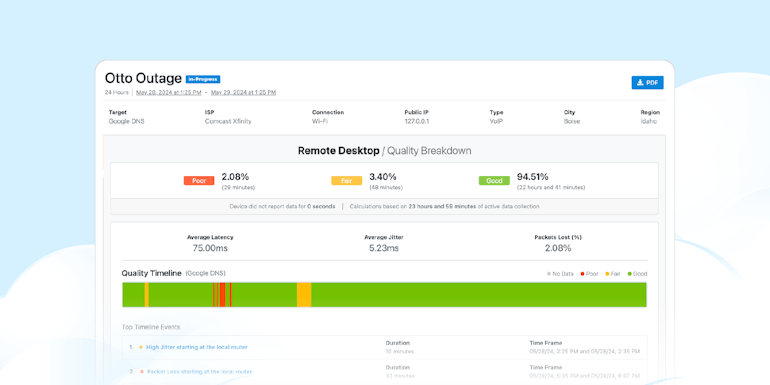

Pre-hire internet connection vetting

NetCheck allows credit unions to test and verify the internet connection quality of potential remote agents before they are hired. Credit unions can ensure that new hires meet the necessary connectivity standards required for effective remote work. By assessing connection quality on a case-by-case basis (or for an entire group of applicants), credit unions can make more informed hiring decisions and avoid issues related to poor connectivity from the outset.

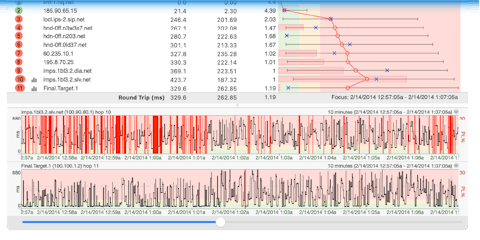

Comprehensive connection data

Unlike standard speed tests that provide only a snapshot of network performance, NetCheck offers a comprehensive view of a WFH agent’s connection over a longer period, typically 24 hours. This extended monitoring provides a more accurate picture of an agent’s internet health and helps identify potential issues that might not be apparent in a brief speed test.

Streamlined onboarding process

With NetCheck, credit unions can streamline the onboarding process by addressing network issues before new hires start working. This proactive approach minimizes disruptions and ensures that remote agents are ready to perform their duties without technical hiccups, leading to a smoother transition and faster ramp-up times.

Improved performance management

By utilizing NetCheck, credit unions can better manage and monitor the performance of their remote agents. With reliable connection data at their disposal, managers can address connectivity-related performance issues more effectively and provide targeted support to agents facing technical challenges. Managers can also identify patterns showing agents who continuously experience internet downtime on Friday afternoons or around major holidays, highlighting those agents who may not be performing to standard.

The final word

The shift to remote work in credit union contact centers has been a boon to credit unions. Utilizing WFH contact centers has allowed credit unions to be more flexible and responsive to members—which translates to a better member experience. By leveraging tools like PingPlotter’s NetCheck, credit unions can address key issues related to WFH internet quality, hiring, and performance management to ensure that members experience top-notch service and support at every step of the journey.

As the remote work landscape continues to evolve, adopting innovative solutions will be crucial for maintaining high standards of service and operational efficiency. NetCheck offers a valuable solution for credit unions aiming to navigate the complexities of remote work while ensuring that their contact center operations remain robust and effective.