The Role of Remote Internet Monitoring in Credit Union Contact Centers

For some time now, credit unions have been locked in an escalating arms race to enhance the member experience. After all, cultivating a favorable and meaningful MX is the linchpin to building long-term memberships and up-selling or cross-selling additional financial products. It’s a winning strategy that translates to happy members and healthy credit unions.

In recent years, digital transformation has emerged as a critical tool to improve the member experience. Simply put, digital transformation for credit unions is the strategic application of technology to enhance member experience and operational efficiency. This can take many forms—from robust online and mobile banking options to improving the efficiency and effectiveness of remote contact centers.

Digital transformation for credit unions: Why it’s a big deal

Digital transformation is more than just a trend—it's a strategic necessity for credit unions striving to meet modern member expectations. Here’s why:

Enhanced member engagement

In today’s digital age, members expect seamless and personalized service. Digital tools enable credit unions to offer real-time communication channels, tailored financial advice, and quick resolutions to queries. By leveraging advanced technologies, credit unions can foster stronger, more engaging relationships with their members.

Increased operational efficiency

Automation and streamlined processes reduce manual work, lower operational costs, and improve response times. For credit unions, this means more efficient handling of member requests, faster transaction processing, and overall improved service delivery.

Competitive edge

Staying ahead of the curve with the latest technological advancements is crucial for attracting and retaining members. Digital transformation equips credit unions with the tools to offer cutting-edge services, setting them apart from competitors and enhancing their market position.

Sometimes it’s a bumpy road: Challenges in transitioning to a CCaaS system

As credit unions embrace new technologies to boost MX, these digital transformation strategies most often include implementing Cloud Contact Center as a Service (CCaaS) systems.

But for remote contact centers, implementing a CCaaS system invites unique challenges—particularly regarding internet stability and performance. After all, if you’re looking to upgrade to a CCaaS system and your WFH contact center is wrestling with shoddy internet, the implementation isn’t going to go well, and the post-implementation results will be less than stellar. Remote agents and their (sometimes lackluster) internet connections can pose several challenges:

Unpredictable internet quality

Unlike controlled office environments, remote agents operate with varying internet setups. Sometimes they have adequate equipment, sometimes they don’t. Sometimes their ISP is prone to issues. The quality and stability of their connections can be inconsistent, leading to potential disruptions in service.

Troubleshooting complexity

Identifying the root cause of remote internet issues can be aggravating. Is it a problem with the CCaaS platform, the internet connection, or something else? Without clear visibility into network performance, troubleshooting can become a time-consuming process.

Integration issues

Integrating a CCaaS system with existing tools and workflows is always complex. Network issues can exacerbate these integration challenges, causing delays and additional complications.

Cost overruns

Addressing network issues post-implementation can lead to costly delays and increased expenditures. Proactively identifying and resolving potential problems before they affect the transition process is essential to avoiding unnecessary costs and delays.

The gold standard: Reliable internet performance in remote contact centers

As credit unions adapt to remote work environments and CCaaS systems, ensuring internet reliability is absolutely critical. Here’s why network stability matters:

Consistent service quality

CCaaS systems, which rely on Voice over Internet Protocol (VoIP) for call handling, are highly sensitive to network performance issues. Problems such as latency, packet loss, and jitter can disrupt call quality, affecting member satisfaction and agent efficiency.

Real-time problem solving

Remote contact centers often use various real-time data tools integrated into their CCaaS platforms. Network instability can impede the accuracy and timeliness of this data, leading to delays in issue resolution and impacting operational effectiveness.

Enhanced productivity and morale

Frequent connectivity issues can hamper productivity and lower morale among remote agents. When an agent is unable to work due to internet issues, that agent’s work load is shifted to others. Persistent network problems can lead to frustration, increased turnover rates, and higher training costs, ultimately affecting the overall efficiency of the remote contact center.

Want a smooth transition to CCaaS? Try this

The rules for implementing a CCaaS system—or any new technology for that matter—are different for remote contact centers. The quality and dependability of an agent’s internet may be unknown, and that variable can negatively impact the transition. To navigate these challenges and ensure a seamless transition to a CCaaS system, consider the following strategies:

Assess network readiness

Evaluate the current state of your remote agents’ internet connections. Test metrics such as bandwidth, latency, and reliability to anticipate potential issues and address them proactively. Better to tackle issues before the transition, rather than risk costly delays.

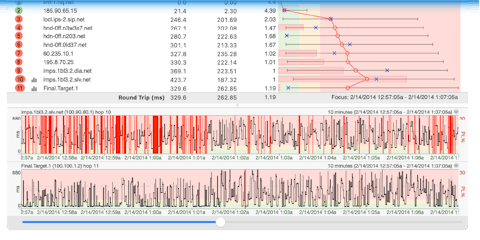

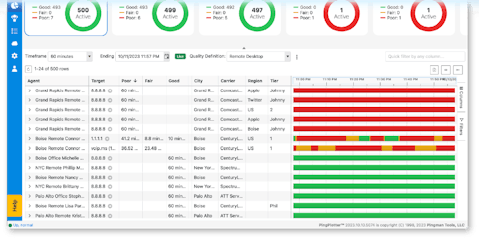

Implement monitoring tools

If you don’t know what your remote internet network looks like, you can’t address problems. Utilize network monitoring tools to gain insights into your remote network performance. Tools like PingPlotter provide valuable visibility into network issues, enabling proactive troubleshooting and resolution before they impact your CCaaS implementation.

Optimize network performance

Configure Quality of Service (QoS) settings, ensure sufficient bandwidth, and address any network bottlenecks. By optimizing your network, you can enhance the performance of your CCaaS system.

Prepare for troubleshooting

Establish clear troubleshooting protocols and ensure you have the necessary tools in place to quickly identify and resolve network issues. This preparation helps minimize downtime and maintains service quality.

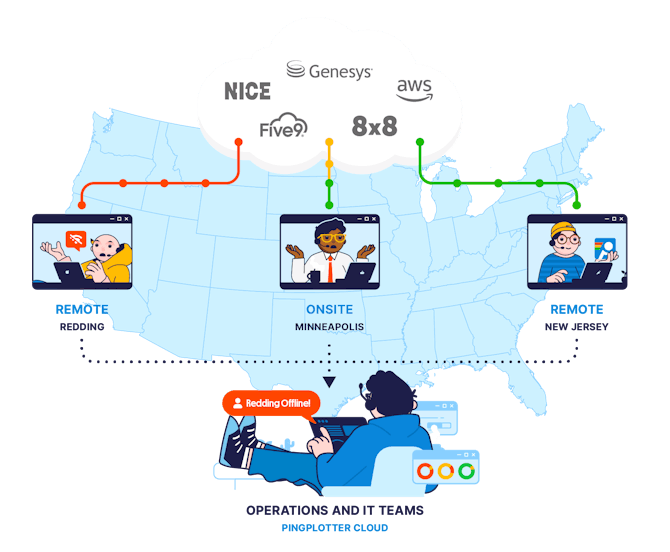

How PingPlotter supports remote credit union contact centers

PingPlotter is designed to address the specific challenges faced by credit union contact centers implementing a digital transformation through a CCaaS system. Here’s how PingPlotter can enhance your remote network performance and help boost the member experience:

Enhanced network visibility

PingPlotter provides deep insights into network performance, helping you identify and address potential bottlenecks and latency issues. This visibility ensures you can resolve network problems before they impact your CCaaS system.

Proactive troubleshooting

With PingPlotter, you can proactively troubleshoot network issues, avoiding delays and cost overruns. By addressing problems early, you can ensure a smoother CCaaS transition and uninterrupted service.

Optimized performance

PingPlotter helps optimize your network for VoIP and data traffic, ensuring reliable and efficient CCaaS performance. This optimization is crucial for maintaining high standards of service.

Real-time monitoring

PingPlotter offers real-time monitoring capabilities, allowing you to continuously track network performance and address issues as they arise. Real-time visibility is essential for maintaining a high-quality CCaaS experience.

The next step

Digital transformation is vital for credit unions aiming to enhance member experience and operational efficiency. By embracing technologies like CCaaS and leveraging advanced network monitoring tools such as PingPlotter, credit unions can overcome the challenges of remote work and ensure seamless service delivery—and most importantly, provide the kind of top-notch experience credit union members have come to expect.

For a personalized demo and to see how PingPlotter can make a difference in your credit union’s remote contact center digital transformation, don’t hesitate to reach out and schedule a session today.